News

Our agreement to acquire Coca-Cola Amatil

04/11/2020

News

04/11/2020

On 14 February 2021 Coca-Cola European Partners announced it has entered into a binding agreement for a best and final offer to the Independent Shareholders of Coca-Cola Amatil Limited (CCL), one of the largest bottlers and distributors of ready-to-drink non alcoholic and alcoholic beverages and coffee in the Asia Pacific region.

“This is a fantastic opportunity to bring together two of the world’s best bottlers to drive faster and more sustainable growth. Since the creation of CCEP four years ago, we have proven our ability to create value through expansion and integration. Now is the right time to move forward by taking on these great franchises and markets.

“The strategic rationale behind this transaction is compelling, solidifying our position as the largest Coca-Cola bottler by revenue. I am eager to apply our proven formula in Western Europe to Coca-Cola Amatil’s markets, including leadership in areas such as revenue growth management, in-market execution, digital and sustainability. However, I am equally excited and genuinely convinced that there will be many more opportunities as we move forward together with speed, scale, excellent people and a richer, more diverse culture.

“This larger platform will unlock enhanced value for our shareholders, all underpinned by an even stronger and more aligned strategic partnership with The Coca-Cola Company and our other brand partners. We look forward to executing on the ambitious growth plans ahead of us, as we build on the best of who we are and create a very exciting future together.”

Compelling strategic rationale

Brings together two of the world’s best bottlers

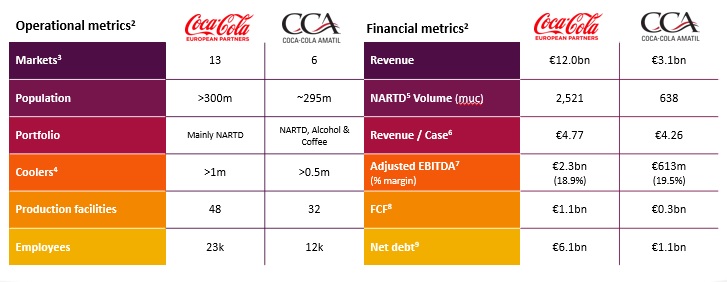

1.Non-alcoholic ready to drink (NARTD) Euromonitor 2019 data for off-trade RSV

2.Data based on 2019 CCEP Integrated Report and 2019 Amatil Annual Report. Average 2019 EUR/AUD FX rate of 1.61

3.CCEP = ES, PO, GB, FR, DE, IS, BE, NL, NO, SE, AD, LU, MC; Amatil=AU, NZ, FJ, WS, ID, PNG

4.As at 31 December 2019 for CCEP & Coca-Cola Amatil

5.Non-alcoholic ready to drink

6.Calculated as NARTD reported revenue over total reported unit case volume. Amatil does not include revenues from Alcohol & coffee, Corporate & Services

7.See previous slide

8.Defined as net cash flow from operating activities less purchases of PPE & capitalised software, less interest paid & payments of principal on lease obligations, add proceeds from sales of PPE

9.As defined within CCEP 2019 Integrated Report and Amatil 2019 Annual Report respectively

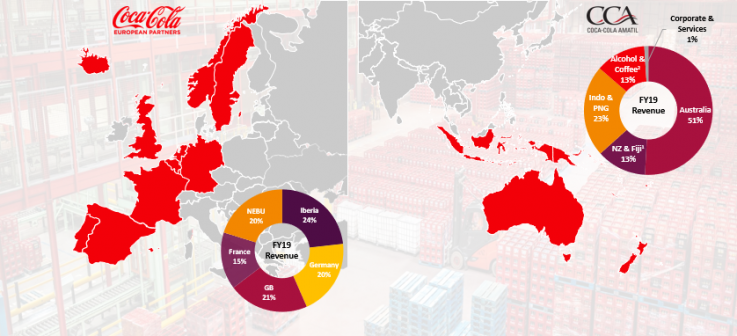

Provides further geographic diversification - with a broader & more balanced footprint

Next steps

Supporting materials